In-depth | Will the Latest Private Health Reforms Bring Down Prices?

The government took its first steps towards the implementation of the recommendation of Health Market Inquiry into the private healthcare sector.

Medical aid schemes will be given collective power to negotiate prices, according to draft regulations published last week. While some see the move as an important step toward reining in private healthcare prices, others argue that they do not go far enough and are legally unsound. We spoke to several leading experts about the proposed reforms.

Complaints about the high cost of private healthcare services in South Africa are nothing new. For the last two decades, above inflation increases to medical aid scheme premiums have been the norm. Added to this, many of the 16 or so percent of the population who are members of a scheme will have been asked to pay unexpected out-of-pocket co-payments at some point.

To understand why all this is happening, the Competition Commission launched a Health Market Inquiry (HMI) in 2014. The final HMI report, published in 2019, found that government had failed in its duty to regulate the private health sector, which it described as “neither efficient [nor] competitive”.

This failure in regulation has resulted in a private healthcare market that is “highly concentrated”, “characterised by high and rising costs of healthcare and medical scheme cover, and significant over utilisation without stakeholders being able to demonstrate associated improvements in health outcomes”, Justice Sandile Ngcobo, chairperson of the HMI panel, said at the time.

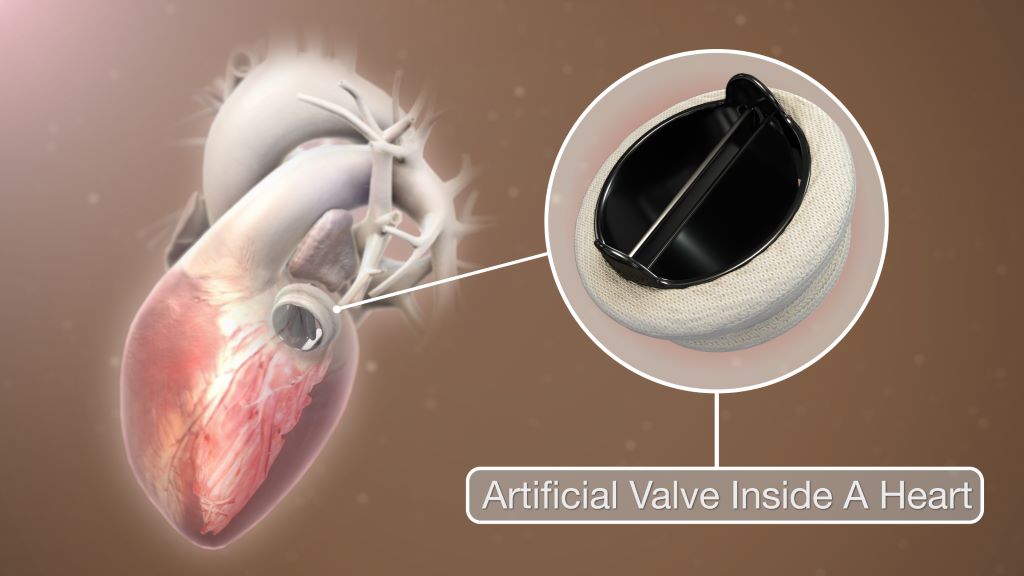

A key regulatory failure identified by the HMI was the absence of any effective mechanisms to keep prices under control. Medical aid schemes would set a price that they would cover – but there is nothing stopping healthcare providers from charging much higher prices. This is particularly a problem for prescribed minimum benefits (PMBs) – a set of healthcare services that schemes have to cover in full.

The HMI recommended the establishment of a supply side regulatory authority (SSRA) that would be independent from both government and the private sector. Among others, the SSRA would set maximum tariffs for PMBs as well as reference tariffs for all other health services.

In September 2020, around a year after the HMI report was released, the Competition Commission published a notice that seemed to set the ball rolling on establishing a new tariff negotiating framework along the lines of the HMI recommendation. Their proposed multilateral negotiating forum would have been governed by the Council for Medical Schemes until the SSRA could be established. But things then largely went silent, until earlier this month.

A new tariff-setting framework

On 14 February 2025, draft regulations published by the Minister of Trade Industry and Competition, Parks Tau, set out a new tariff determination framework for private healthcare in South Africa. At its core are two structures. The Tariffs Governing Body (TGB), consisting mainly of experts responsible for providing oversight in the tariff determination process, and the Multilateral Negotiating Forum (MLNF) made up of multiple stakeholders “which shall serve as the primary forum for collectively determining the maximum tariffs for prescribed and non-prescribed minimum benefits for healthcare services”.

In short, the work of negotiating and determining tariffs will be done by the MLNF, with the TGB providing some oversight and support. The TGB is also empowered to make a tariff determination when the MLNF fails to reach agreement.

The National Department of Health will have substantial control over both structures. Members of the MLNF will be appointed by the Director General of Health, and will include representatives of government, associations representing healthcare practitioners, healthcare funders, civil society, patient and consumer rights organisations, and any other regulatory body within the healthcare sector. The TGB will be located in the National Department of Health and will be chaired by an official of the department.

The regulations came in the form of a draft interim “block exemption” from certain provisions in the Competition Act. Such an exemption is required in order to enable the tariff governing body and the multilateral negotiating forum to function legally. The stated purpose of the exemption is to “contribute to the affordability of quality healthcare services…reduce costs and prevent the overutilization of healthcare services”.

In addition to the “collective determination of healthcare services tariffs”, the exemption also provides for “the collective determination of standardised diagnosis, procedure, medical device and treatment codes”, and “the collective determination of quality measurements/metrics, medicines formularies and treatment protocols/guidelines with the purpose of contributing to affordability of quality healthcare services across both PMBs and non-PMBs, contributing to reducing costs and contributing to the prevention of overutilization of healthcare services”.

The exemption doesn’t apply to everyone in the health sector. While healthcare providers like GPs and specialists are included, hospitals are not included.

Not an independent entity

While generally in favour of implementing the HMI recommendations, several experts Spotlight consulted are critical of how the government is going about it.

One line of criticism has been that the new framework is not sufficiently independent from the health department, as recommended in the HMI report.

Professor Alex van den Heever, Chair of Social Security Systems Administration and Management Studies at the University of the Witwatersrand (Wits), said the regulations deviate from the requirement for independence of any price regulator from political interference – which he points out is expressly addressed by the HMI.

In a media conference on Monday, Health Minister Dr Aaron Motsoaledi cited financial constraints for failing to set up an independent regulatory body. He also said that the department had a “mandate to manage healthcare systems”.

“We’re still looking at various options on an independent regulator, but National Treasury has severe constraints,” he said.

The exemption is for a period of three years and has been described as an interim measure.

Piecemeal implementation?

Another line of criticism is that only some HMI recommendations are being implemented, whereas the HMI stressed the need for an “inter-related” approach. While the tariff-determinations may bring down prices, it will not prevent doctors from, for example, sending people for medically unnecessary scans (a form of overutilisation).

Sharon Fonn, a professor in the School of Public Health at Wits and who was part of the HMI panel, said implementing aspects of the HMI piecemeal will neither foster competition nor protect the consumer.

“Controlling prices achieves little in the absence of the recommended holistic framework, which addresses the incentives of schemes to contract on cost, quality and demand,” she said.

Costs are influenced by both price and demand. The HMI did extensive work to show that supplier-induced demand was a problem – clearly indicating that price controls would achieve nothing in the absence of broader interventions, said Van den Heever.

“You’ll be hard pressed to find tariffs rising much faster than CPI (Consumer Price Index),” said Van den Heever. “Costs rise because of claims volumes, not the tariffs. This is because the frequency of patient consultations or in-patient days can rise in response to a fixing of prices. Providers are in a position to influence this demand. Annually you could have a 3% actual cost increase, with only a third of the increase (one percentage point) due to original price (tariff) changes. This is fully addressed in the HMI,” he added.

In response to criticism over the piecemeal implementation of HMI recommendations, Motsoaledi stressed that the HMI conceded that its recommendations would be implemented in phases.

Questions of scope

Elsabe Klink, an independent healthcare legal consultant and former advisor to the South African Medical Association, said government is mixing up the coding, protocols and Health Technology Assessments (HTA) which, on the HMI recommendations, are not up for negotiation in the MNLF.

“The HMI recommended that those functions be separate. How on earth can people negotiate on how a diabetic patient can be treated. That is a scientific question,” she said.

Klink said the HTA seems to be a veiled attempt at price control, directly for healthcare professionals and indirectly, to bar from the market devices and medications that did not make it onto the protocols or formularies.

“It [the draft regulations] purports to implement Health Market Inquiry recommendations but seems to stray into issues that are integral to NHI implementation as well, notably the HTA Committee,” said Dr Andy Gray, pharmaceutical sciences expert at the University of KwaZulu-Natal and Co-Director of the WHO Collaborating Centre on Pharmaceutical Policy and Evidence Based Practice.

Justifying the HTA measures, Motsoaledi said it was to prevent “the medical arms race” where healthcare practitioners prioritised patient volumes to enable them to beat their opponents in offering the latest technology. “This behaviour ruled by a medical arms race must end,” he said. He did not specifically explain why HTA was included in the exemption and not addressed through other regulations.

Questions of legality

Questions have also been raised over the legality of the regulations and whether or not they’d be vulnerable to litigation.

Van den Heever described the new regulations as “quite strange and extremely untidy, exposing the entire enterprise to legal challenge from the outset”. He said that the exemption bypasses normal legislative processes, that require evidence-based motivations and wide consultation.

He said the exemption went beyond competition concerns by establishing new governance structures that resembled a regulatory framework rather than a competition-related exemption.

“Furthermore, the structures and framework apply to a different minister (Health) – who has the legal authority to establish such a framework – not the Minister of Trade Industry and Competition. The Competition Act provides for exemptions, but only to facilitate competition-related objectives,” he said.

Dr Rajesh Patel, the Head of the Health System Strengthening Department at the Board of Healthcare Funders, had similar concerns. He said he finds it strange that “you need the Department of Trade Industry and Competition to tell the Department of Health to do their work”.

Could providers opt out?

Another contentious, and not entirely clear, aspect of the new framework is whether healthcare providers will be able to charge higher prices than those agreed through the MLNF.

“Perhaps one of the most problematic elements is that to protect patients, there needs to be some system to prevent opting out. It is likely that providers will opt out of this system and pass on additional costs to patients,” warned Fonn.

But, when asked about healthcare providers potentially opting out, Motsoaledi said that if that happened, “we’d be back to square one where everybody can charge whatever they want. I don’t think the HMI wanted that.” He didn’t specifically clarify how the current reforms would prevent healthcare professionals from opting out.

According to the draft regulations, the tariffs determined by the MLNF are “binding on all parties to the agreement”. It does however leave the door open for bilateral negotiations outside of the MLNF, but “only for the purpose of concluding an agreement on reductions, but not increases, on the tariffs for PMBs and non-PMBs as determined by the MLNF process”. There appears to be nothing in the regulations that would prevent healthcare providers from opting out altogether and charging what they like – although it is unclear to what extent, if at all, schemes would reimburse in such instances.

Concerns over timing

On timing, there are both concerns over how long the process has taken so far, and how long it might take going forward. This month’s draft regulations were published roughly five and a half years after the publication of the HMI report. For most of this period, Motsoaledi was not health minister.

Motsoaledi blamed the COVID-19 pandemic and the national elections that followed shortly afterward for the delay.

Patel expressed serious reservations about the ability of the health department to implement the block exemption process. “If their history is anything to go by, we will see similar delays and consequently, rising healthcare costs,” he said.

Patel said that the quickest solution to render private healthcare more affordable would be if the Competition Commission granted exemptions to allow medical schemes to collectively negotiate tariffs with willing healthcare providers. The health department, he said, need not be involved at all.

“We have serious reservations about the Department of Trade, Industry and Competition putting the power in the Department of Health’s hands to manage the block exemption process. They have actively kept private healthcare expensive and inaccessible to justify the implementation of the NHI,” he claimed.

Spotlight sent written questions to the Department of Health last week and during Monday’s media conference. Though some of our questions were addressed in the media conference, others had not been responded to by the time of publication.

– Additional reporting by Marcus Low.

Republished from Spotlight under a Creative Commons licence.

Read the original article.