By Matshidiso Lencoasa and Dominic Brown for Spotlight

In the context of weak economic growth, lower-than-expected tax revenues, and the implementation of measures to reduce public spending, there is “rising panic” ahead of this year’s Medium Term Budget Policy Statement (MTBPS). The concern for health care provision is palpable as anticipated budget cuts threaten the country’s already fragile and understaffed public healthcare system. There is only one nurse for every 224 patients in the public health system, and over 5 000 nursing posts remain unfilled (something primarily attributed to funding constraints).

In times of poor economic performance, difficult policy choices and trade-offs arise, and it may be tempting for fiscal policymakers to slash public health spending. However, without meaningful consideration of the impact of these decisions on our people and our constitutional right to access healthcare, the MTBPS risks exacerbating the hardships faced in our country.

Austerity context

South Africa’s economic outlook has been riddled with challenges permeating our healthcare system. Over the past decade, the country’s economic growth has underperformed, falling in real terms from 2.3% in 2013 to 0.1% in 2023. National Treasury has responded to this with cuts to social spending, including healthcare. Public health is receiving fewer resources in real terms, and our government spends more on debt-servicing (R340.5 billion in the 2023/24 Budget) than on healthcare (R259.2 billion in the 2023/24 Budget). Moreover, healthcare’s allocation of R259 billion in 2023/24 was the same as last year’s allocation, meaning that the value of resources allocated to healthcare this year is eroded by Consumer Price Index (CPI) inflation, which was projected to be 4.9% at the time of the Budget Speech in February this year.

Worse, this allocation needed to account for the rising demand projected for public healthcare services. Currently, about 84% of the population relies on the public health care system. This figure is projected to increase in response to population growth and rising unemployment making medical aid inaccessible for many in the country.

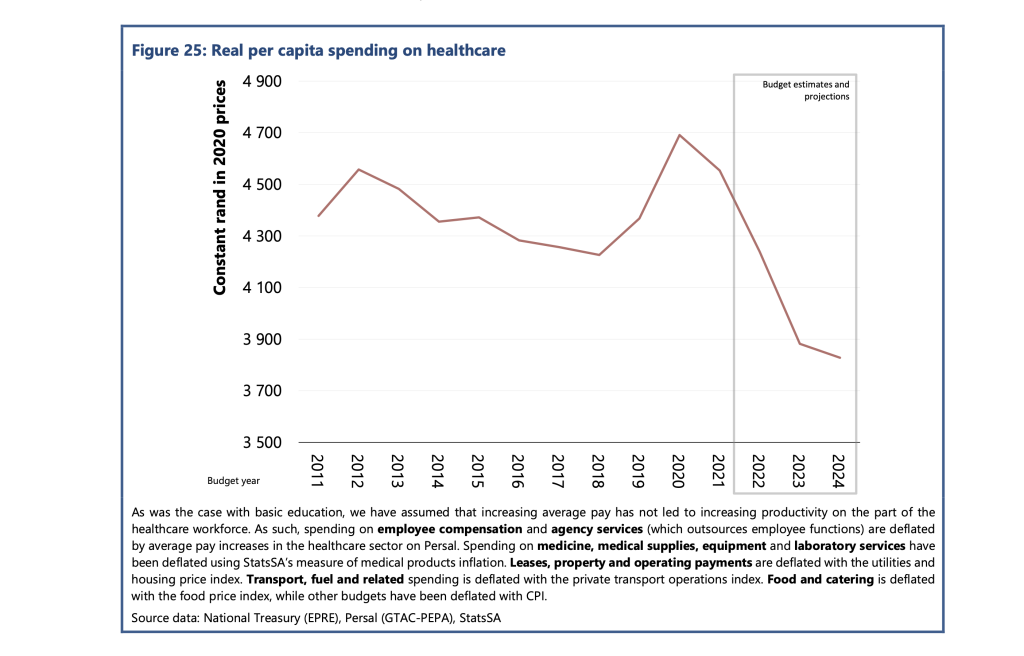

According to the Public Economy Project, after accounting for inflation and population growth, the spending per healthcare user fell from approximately R4600 in 2012 to R4300 in 2018. Based on current budget estimates, it is projected that real per capita public health spending will fall below R3 900 by 2024/25.

Implications for health care staffing

Although the 2023/24 budget proposed a measly 1.5% nominal increase to the public sector wage bill, President Cyril Ramaphosa approved a 3.8% increase for this year. However, Treasury’s cost containment measures have stipulated a hiring freeze for the rest of the 2023/24 financial year and no further allocations towards personnel expenditure. This is despite the Department of Health’s 2030 Human Resources for Health Strategy quantifying that 96 586 additional health workers are required to bolster the healthcare of all provinces to the same standard as the third-ranked province by 2025. This requires an additional cost of nearly R40 billion in total.

The real-life implications for South Africans are dire. Chris Hani Baragwanath Hospital – the largest hospital in Africa and the third largest hospital globally – faces significant staff shortages, cancelling almost 900 surgeries in 2022. The underpaid and overworked Chris Hani Baragwanath Hospital nurses have reported “pooling funds to buy patients bread.” Doctors at Nelson Mandela Bay’s Livingstone Tertiary Hospital have attributed “suboptimal, undignified patient care” to budget shortages and forecast higher medico-legal claims, which National Treasury described as a “sub-national risk”. However, budget measures that impede public health care’s ability to address staff shortages exacerbate the likelihood of errors by overstretched staff, worsening the medico-legal claims bill for health departments.

Gender and budget cuts

Health budget cuts disproportionately burden women. This burden is evident in the inordinate risk and prevalence of HIV that women face in the country. It is exacerbated by women’s higher and differentiated health needs (including those for reproductive and maternal health). Women-led households are 40% poorer, and unemployment is most prevalent among women. These socioeconomic factors make women more dependent on the public health system.

Budget cuts and underspending clearly have implications for gender equity in the country.

Furthermore, the Department of Health has recognised the healthcare workforce as a critical driver of inclusive economic growth and a means to create decent work for women, especially in rural and underserved communities. Over 90% of nurses in our public health system are women, and in our society of unequal gendered norms, it is also women who carry the care work burden in the home. Many will likely interpret any proposed MTBPS cuts without factoring gender equity implications as an under-appreciation of women’s labour in making a fragile healthcare system and society work.

A case for human rights budgeting

Although improving the country’s economic outlook is imperative, without consideration of the power that fiscal policy has in advancing human rights in the country, there is a likelihood of tabling an MTBPS that impedes the realisation of constitutionally guaranteed human rights in the country.

More than ever, our health system requires inculcation of human rights impact assessments as recommended by the UN Committee on Economic, Social and Cultural Rights, to which South Africa is a party. These assessments could compel policymakers to outline how the resources allocated will protect the right to access healthcare for all in the country, especially when budget cuts are considered. Including these considerations in budget policy may further advance meaningful public participation processes in fiscal policy.

Furthermore, a gender-responsive MTBPS is long overdue and a powerful means to protect the most vulnerable people in the country from reduced social investment. The health budget could be tagged to identify programmes with gender as a principal or significant objective and areas which would need to be protected and consideration of the gendered experience of healthcare to prevent fiscal policy from worsening gender inequities in the country. Budget policymakers should further promote the collection of gender-disaggregated data and establish indicators and benchmarks on gender and other socio-economic factors to advance a more equitable funding allocation.

Lastly, authentic public engagement will allow National Treasury and budget policymakers to solicit and table more equitable fiscal expansion alternatives. Increased public consultation could include extending the pre-budget consultations with the public.

Moreover, civil society organisations like the Institute of Economic Justice and the Alternative Information and Development Centre (AIDC) have proposed alternative approaches to fiscal constraints that could ensure sufficient resources to protect our frail public health system from threats to resource availability. These alternatives should be explored.

One strategy proposed is strengthening the country’s capacity to halt the significant revenue losses owing to to corporate tax abuses, including illicit financial flows (IFF) and base erosion and profit shifting (BEPS). IFF refers to the cross-border movement of illegally sourced funds while BEPS refers to when multinational companies shift the profits generated in South Africa to another jurisdiction that has lower or zero tax rates in order to minimise their tax burden.

The Financial Intelligence Centre estimates that between $15 billion and $25 billion is shifted out of our country to tax havens yearly. We call for greater urgency towards implementing publicly disclosed beneficial ownership registries based on country-by-country reporting and the automatic exchange of information, strengthening capital and exchange controls, and increasing South African Revenues Services (SARS) capacity to investigate corporations suspected to be involved in IFF and BEPS. These essential measures can contribute to curbing profit shifting, resulting in more than R100 billion in revenue each year.

The upcoming MTBPS will find National Treasury in a challenging position where various trade-offs will likely be made. In this harsh economic climate, if something has to give, it cannot be the constitutional right to health care for all in this country.

*Lencoasa is a Budget Researcher at SECTION27 and Steering Committee Member of the Budget Justice Coalition. Brown is Director of the Alternative Information and Development Centre and member of the Budget Justice Coalition.

Republished from Spotlight under a Creative Commons Licence.

Source: Spotlight